NexGenSpin: Emerging Player in the Crash Games Niche

As someone who's been knee-deep in the iGaming world for over a decade, watching trends shift from classic slots to сrypto сasinos and now crash games, I always keep an eye on newcomers. NexGenSpin popped up on my radar earlier this year, launching in early 2025 without much fanfare. They're a small outfit focusing on crash-style casino games, and while they've got some early buzz in the industry, they're still very much in startup mode—no full license yet, which is a red flag for operators in regulated markets. I pulled together this review based on a direct interview with one of their team members, plus a bit of digging into their online presence. It's not a sales pitch; think of it as a balanced rundown from someone who's seen plenty of promising studios fizzle out.

Company Background: A Remote Startup with Big Ideas

NexGenSpin kicked off around February or March 2025, dropping their first game by late April and testing integrations with partners by mid-May. From the interview, it's clear they're inspired by viral trends—think memes, classic arcade vibes, and hit series like Squid Game. Their mission? To shake up iGaming with fresh mechanics that boost player retention without skimping on creativity. They're all about metrics-driven decisions, tracking everything from session lengths to RTP deltas, but they balance that with fun, thematic designs.

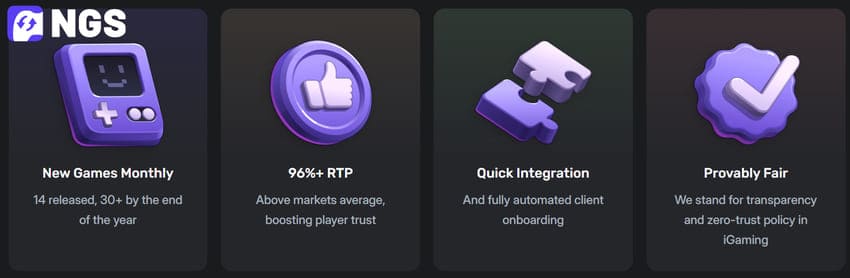

No physical HQ here; the team's fully remote, scattered worldwide, and the company's still wrapping up registration as of September 2025. That means they're operating in a gray area for now, which isn't unusual for bootstrapped startups but does limit their reach until they nail down certifications. On their website, they tout quick setups and multi-currency support, positioning themselves as agile upstarts ready to partner globally.

Team and Expertise: Small but Capable

With under 15 people, NexGenSpin qualifies as a true startup. The crew covers product management, development, and illustration, handling the full game lifecycle in-house—from brainstorming ideas to sound design and API integrations. Product folks bring 3 to 10 years of iGaming experience, including stints at casinos, payment processors, and even non-gambling game promo gigs. No big-name founders mentioned in the chat, and their site doesn't spotlight execs either, which keeps things low-key.

What stands out is their collaborative vibe: roles are clear-cut (one marketer, a handful of artists and devs), but ideas flow freely. For instance, their bizdev guy sparked the first game concept, and marketing pushed for a timely Squid Game tie-in. It's refreshing compared to bloated teams at giants like Playtech, but let's be real—small size means they're stretched thin, and scaling could be a hurdle.

Products and Portfolio: Crash Games with a Twist

Right now, NexGenSpin's all-in on crash games for casinos, skipping slots entirely. They've got two publicly released titles as of September 2025, with five more in closed beta. These aren't your standard multipliers; they weave in themes from memes and pop culture for that extra hook.

- Crazy Potato Free Demo (Released April 29, 2025): You play as a potato dodging kitchen hazards toward a big payout. It's got high volatility, a 96.10% RTP, and bets from $0.10 to $10,000, with a max multiplier over 3 million. Fun concept, but the meme angle might not age well.

- Crocodilo Free Demo (Released August 25, 2025): Based on a viral meme, this one's about launching a plane for massive wins. 98.00% RTP, same high volatility and bet range, capping at a billion-times multiplier. Wild potential, if you're into high-risk thrills.

They mentioned a third, Glass Bridge, inspired by Squid Game, which early feedback highlights for its risk-intuition mechanics and modes (easy, medium, hard). All games track 18 metrics internally, like average session duration, retention rates (Day-1/7/30), and crash-free sessions. This data obsession helps operators tweak performance, but it's aimed more at B2B partners than players directly. End-users get the fun side: daily quests, leaderboards, and social features to keep things engaging.

|

Key Metrics Tracked |

Description |

|

Average Session Duration |

How long players stick around per play |

|

RTP (Actual - Theoretical) |

Gap between expected and real returns |

|

Conversion (Open to Launch) |

Percentage who start after viewing |

|

Average Bet per Session |

Typical wager amount |

|

Average Loss/Win per Session |

Net outcomes for balancing |

|

Total/Average Bets per User |

Volume of action |

|

Starting Balance |

Initial player funds |

|

Balance Top-Ups from Zero |

Refills when broke |

|

Anomalous RTP Players |

Flagging unusual win rates |

|

Retention (D1/D7/D30) |

Return rates over time |

|

Average Launch Balance |

Funds when starting |

|

Crash-Free Sessions % |

Reliability metric |

|

Feature Adoption Rate |

Use of quests/leaderboards |

|

A/B Win Ratio |

Test variant performance |

|

Mean Time to Release (MTR) |

Development speed |

|

Game Volatility Index |

Risk level gauge |

Oriented toward operators and aggregators, but player-focused design shines through in the themes and mechanics.

Innovations and Tech: Solid Basics, Nothing Groundbreaking Yet

They're incorporating social elements like quests and leaderboards across games, with a competitive mechanic teased for future releases. Tech-wise, balanced servers ensure smooth play worldwide, modern APIs for quick integrations, and optimizations to cut Time to First Byte (TTFB) to 14 seconds on any device. Blockchain-based provably fair RNG is a nice touch—server seeds, client seeds, and nonces let players verify outcomes post-game.

No AI, VR, or blockchain beyond fairness, though. It's practical stuff that improves UX and ops efficiency, but in a crowded field, it's more catch-up than innovation. Their site promises monthly releases and custom branding, which could appeal to niche casinos.

Competitive Edge: Flexibility Over Firepower

Against heavyweights like Playtech or SOFTSWISS, NexGenSpin can't match resources, but they counter with nimbleness. They'll customize on the fly—adding freebet support or social tweaks per client request. Focus on retention via social mechanics addresses a big industry pain point, where players churn fast in crash games.

Unique value? Games tied to timely trends (e.g., releasing Glass Bridge alongside a Squid Game season) and deep analytics for partners. For players, it's the interactive, meme-driven fun; for operators, scalability and insights that drive revenue without massive upfront costs.

Regulatory Compliance and Responsible Gaming

Here's where caution kicks in: No licenses or certs yet, though they're pursuing GLI and provably fair audits post-registration. They emphasize fairness on their site, with blockchain RNG that's verifiable— a solid step for trust in unregulated spaces. No specific responsible gaming tools mentioned beyond that, like self-exclusion or limits, which is a gap for a new entrant. As an expert, I'd say hold off on partnerships until those boxes are ticked; the iGaming regs are tightening globally.

Achievements and Case Studies: Early Days

No awards or big wins yet—plans for 2026. Highlight: Whipping up Glass Bridge in a month to coincide with Squid Game's new season. It's a clever move showing agility, but without metrics on uptake, it's anecdotal. There’s already growing aggregator interest, which is promising.

Benefits for Players and Operators

Players get diverse, themed crash experiences with social hooks that make sessions more than just betting—quests and leaderboards add replay value. Interfaces are mobile-friendly, with immersive sounds and fast loads.

Operators benefit from easy integration, real-time metrics (soon via site dashboards), and custom options that scale without breaking the bank. Retention focus could mean steadier revenue, but the small portfolio limits variety for now.

Company Culture and Values

Flat structure here: CEO sets direction, but team members own their domains and pitch ideas actively. It's collaborative, fostering innovation without bureaucracy. No major CSR initiatives yet—they're too new—but transparency in comms (online and at conferences) is a core value.

Challenges and Outlook

Biggest hurdle? Getting noticed in a noisy market without deep marketing pockets. Their plan: Build standout products and chat openly with the community. Looking ahead, they're eyeing trends like social gaming and global accessibility, aiming for 30 games and spots in two major aggregators by year-end. If they deliver, they could carve a niche; if not, they risk fading.

Final Thoughts: Promising but Proceed with Caution

NexGenSpin's got a fresh take on crash games, blending metrics smarts with cultural hooks that could resonate in emerging markets. The small team punches above its weight in agility, and features like provably fair tech build credibility. But as an industry vet, I'd rate them cautiously—around 2.8/5 at this stage. No license means they're not ready for prime time in places like the UK or US states. Watch for those certs and portfolio growth; if they hit 30 games without quality dips, they might just stick around. For now, they're worth a demo spin, but not a full commitment.